“Low-Cost”: More Than a Fare, a Philosophy That Changed Aviation. What began as a pricing strategy has become a full-blown philosophy, revolutionising the passenger air transport sector, the wider travel industry, and beyond. For travellers, the most visible impact has been lower ticket prices. Yet, behind the scenes, the shift that started in the 1990s has made air travel accessible to the masses—something that once seemed a privilege for the few. But how much room is left for growth in this sector, which leapt from 3 million passengers in 1994 to 555 million in 2024?

From Deregulation to Disruption. The liberalisation of Europe’s aviation market in 1992 opened the door for any registered carrier to operate routes between EU member states. By 2006, the number of routes with at least three competing airlines had already surged by 300%, leading to a dramatic drop in fares. Two key developments fuelled this shift: the rise of new, agile carriers built around the low-cost model, and a proactive role taken by regional airports in attracting new services.

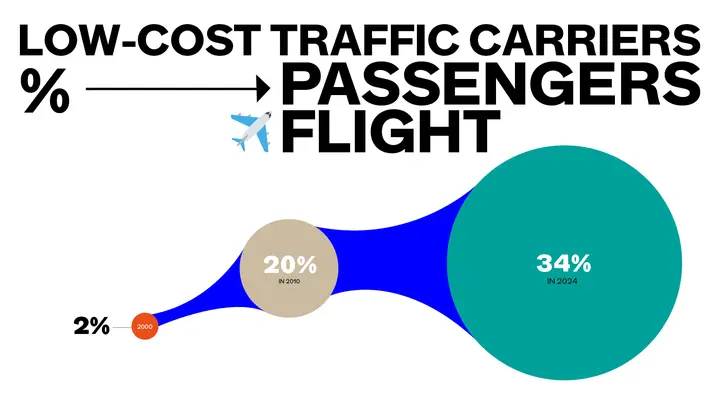

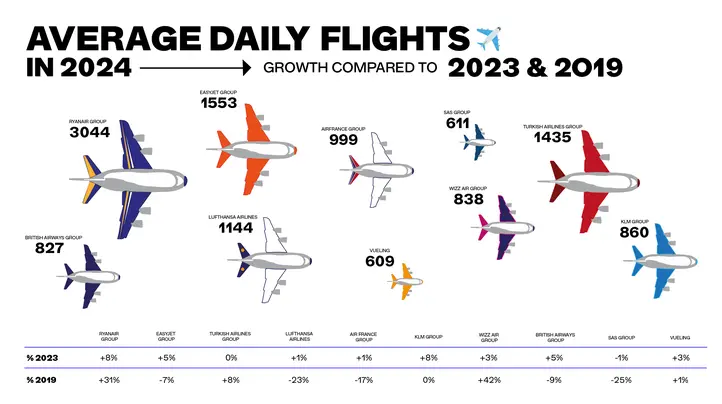

The result was a major upheaval in the industry’s dynamics. Low-cost carriers (LCCs) grew their share of the European passenger market from just 2% in 2000 to 34% in 2024. Traditional airlines still hold a slightly larger share at 36%, yet many have yet to return to pre-2019 traffic levels. LCCs, on the other hand, have already surpassed their pre-Covid performance (+3%, according to Eurocontrol). With 58% of all new aircraft orders in Europe attributed to these carriers (McKinsey data), their expansion outpaces that of legacy airlines.

Ground and air strategies

Low-cost airlines have long relied on a variety of levers to reduce operating costs and offer competitive fares—right down to the smallest detail of their business structure. These include airport selection, aircraft configuration, staffing models, and customer service offerings.

A hallmark of the low-cost model is the use of secondary airports, often located far from the city they claim to serve. These airports offer cheaper landing fees, more flexible slot availability, and less congestion—trade-offs that passengers have been willing to accept for lower prices. In turn, these airports often become engines of regional development, creating jobs and stimulating local economies. The airlines themselves gain negotiating power, especially when public incentives are on offer.

When designing routes, low-cost airlines have introduced the 'point-to-point' model: direct connections from one location to another without the need to pass through a central airport, as is the case with classic airlines ('hub and spoke' model, e.g. Heathrow for British Airways; Istanbul for Turkish Airlines). This flexibility enables an LCC to establish or remove a route depending on market trends while maintaining its 'load factor' (fill rate) and the performance of each flight.

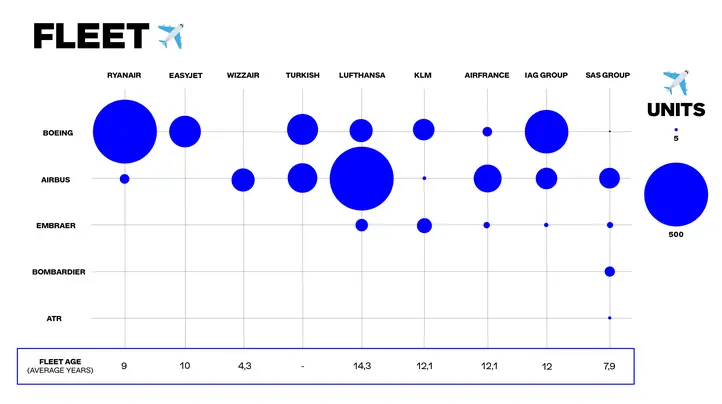

Aircraft selection is just as strategic. LCCs typically operate younger fleets, improving fuel efficiency and reducing maintenance costs. They tend to place bulk orders—often for a single aircraft model—from one manufacturer, enhancing bargaining power and enabling standardised training, maintenance, and operations. Ryanair, for example, has placed orders for up to 300 Boeing 737s, while easyJet has ordered 257 Airbus aircraft.

Lean Resources, High Efficiency

Every element of the low-cost model aims to simplify processes and minimise labour requirements—from shifting check-in online to charging for checked baggage. Labour practices have drawn criticism in some cases, but cost reduction also stems from operational decisions such as using retractable stairs instead of jet bridges.

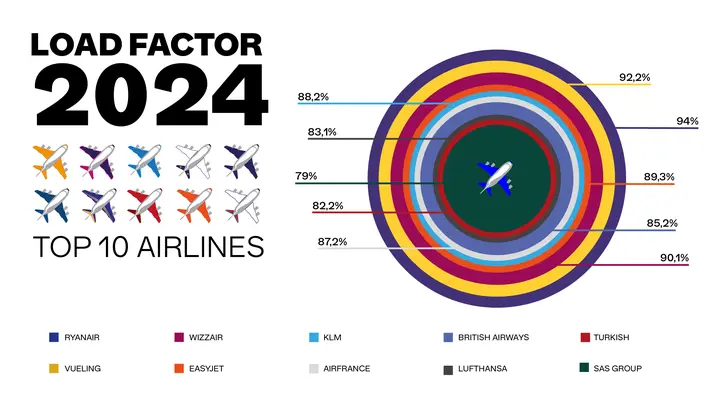

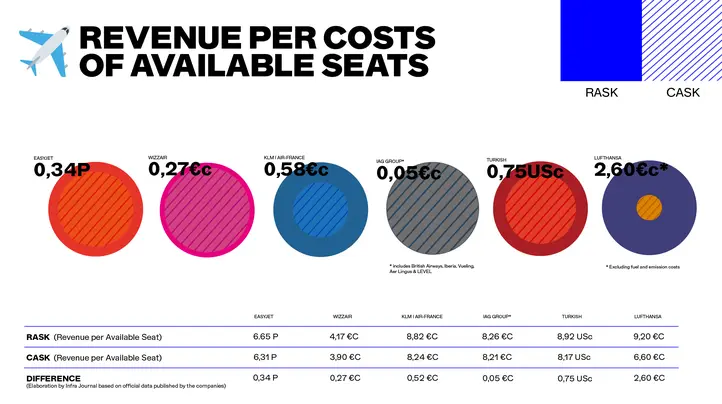

LCCs also tend to achieve higher load factors than traditional carriers, due to their dynamic, demand-driven route planning. This operational efficiency is reflected in industry metrics such as CASK (Cost per Available Seat Kilometre) and RASK (Revenue per Available Seat Kilometre), where low-cost carriers consistently outperform their full-service peers.

Speed, Ancillaries, and the Passenger Experience

Rapid turnaround is another cornerstone of the low-cost strategy. A low-cost aircraft can be ready for departure within just 25 minutes of landing—far quicker than the 40–70 minutes often required by traditional airlines. Several factors contribute: smaller airports, fewer checked bags, simplified cabin layouts, and quicker refuelling.

At the same time, the passenger experience has become a marketplace for ancillary revenue. From extra luggage and seat selection to insurance, transfers, and priority boarding, LCCs have perfected the art of “unbundling” services. These additional offerings often push the total spend far beyond the base fare and are a vital component of the carriers’ revenue model.

Looking Ahead

Few realise that the low-cost model originated with Southwest Airlines in Texas in the 1970s, long before Ryanair and its European counterparts adapted it for the continent. Today, the United States may once again provide a glimpse of what’s to come. Post-Covid, traditional airlines in the US are showing better returns on invested capital than LCCs—a shift highlighted in a McKinsey report.

Several factors underpin this trend: rising labour costs, widening spending gaps between high- and low-income travellers (with the latter cutting back on discretionary purchases), and legacy airlines increasingly offering low-cost-style fares while enhancing overall service quality.

Could this be a sign of what’s to come elsewhere? Time will tell. In 2024, low-cost carriers accounted for 36% of available seat capacity in North America, compared to 60% in Europe. Future developments will depend on factors such as trade tariffs, the effects of overtourism on local communities, and tighter environmental regulations.

One thing is certain: low-cost carriers are not standing still. With hundreds of new aircraft on order—many featuring higher seat densities to boost revenue—and new ideas like “Prime” or “All You Can Fly” subscriptions (and even the ever-rumoured standing seats), the sector continues to evolve. What’s next? Fasten your seatbelts—it’s going to be a turbulent ride.